The European real estate sector stands at a critical juncture. Buildings are at the center of the climate challenge, responsible for around 36% of the EU’s greenhouse gas emissions and 40% of energy consumption. With the EU’s Renovation Wave Strategy targeting 35 million building upgrades by 2030, and increasingly stringent requirements under the European Green Deal, asset managers and consultants are under immense pressure to transform portfolios while still delivering financial returns.

This balancing act between ambitious sustainability goals and pragmatic investment decisions, requires more than good intentions. It calls for sophisticated tools that can navigate distinct local markets, integrate diverse data sources, and translate them into actionable, financially viable strategies.

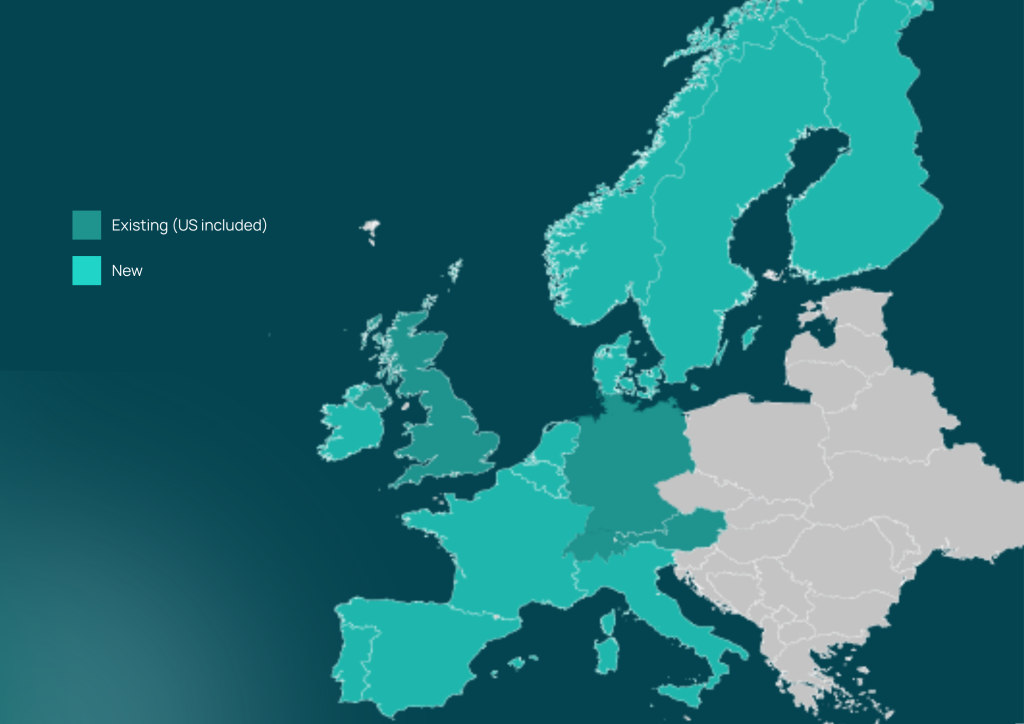

Today, we are proud to share a major milestone in our mission to accelerate real estate decarbonization: Optiml is now live in 11 new European countries.

Welcome Belgium 🇧🇪, Finland 🇫🇮, France 🇫🇷, Ireland 🇮🇪, Italy 🇮🇹, Luxembourg 🇱🇺, Netherlands 🇳🇱, Norway 🇳🇴, Portugal 🇵🇹, Sweden 🇸🇪, and Spain 🇪🇸.

But geographic expansion is just one dimension of our growth. We are bringing localized, data-driven decision intelligence to the heart of Europe’s decarbonization challenge. Every new market comes with its own unique energy landscape, cost structures, regulatory frameworks, and carbon factors that directly influence renovation strategies and investment outcomes. Optiml’s platform now integrates these local nuances, ensuring that strategies are tailored to real-world conditions rather than theoretical assumptions.

Why Localization Matters for Asset & Portfolio Strategies

“Buildings are snowflakes” and strategies are not a one-size-fits-all exercise. A retrofit strategy that delivers strong returns in Amsterdam may fail entirely in Barcelona. What explains this divergence?

First, real estate markets and construction costs reflect local realities. The price of labor, materials, and financing can vary dramatically, shaping ROI calculations. For example, insulation upgrades or HVAC replacements may be cost-effective in one market but prohibitively expensive in another.

Real estate markets and construction costs vary widely across Europe, shaping the financial viability of decarbonization strategies. At the same time, energy mixes and carbon factors differ sharply. From Norway’s 98% renewable grid at just 13g CO₂/kWh to Italy’s heavier fossil reliance at 280g CO₂/kWh- directly influencing the impact of any intervention.

Third, regulatory frameworks evolve differently across countries. While the Energy Performance of Buildings Directive (EPBD) sets EU-wide targets, each member state interprets and implements it in its own way. Similarly, compliance with the EU Taxonomy for sustainable activities depends heavily on national regulations and enforcement. For asset managers, this means that a decarbonization plan cannot simply be copied from one country to another.

By integrating all of these factors, Optiml helps ensure that strategies are not only technically sound but also aligned with the market realities of each country.

Real Impact for Real Estate Professionals

For asset managers with pan-European portfolios, this expansion has immediate implications. They can now design portfolio-wide strategies that account for local variations in construction costs & energy prices, carbon intensity, and regulations - without needing to rely on fragmented, inconsistent data.

This makes it possible to generate accurate ROI projections that reflect country-specific financing costs and market conditions. It also supports the creation of compliance strategies that align with different national timelines for EPBD implementation and climate neutrality goals.

Equally important, Optiml supports risk assessment by integrating regional energy market volatility and stranding risk analysis. With the cost of inaction rising - both financially and reputationally - having the ability to identify and mitigate these risks is becoming an essential part of portfolio management.

For consultants serving diverse European clients, the benefits are just as significant. Instead of spending weeks gathering fragmented local data, they can now produce faster and more credible analyses across major European markets. This means recommendations are not only backed by verified local intelligence but also delivered more efficiently, improving client satisfaction and project margins. Consultants gain a competitive advantage by leveraging insights that traditional tools cannot provide, positioning themselves as strategic partners in the decarbonization journey.

Beyond Geographic Expansion: Toward Deeper Intelligence

While geographic expansion is an important milestone, the real story lies in deeper Real Estate Decision Intelligence. By integrating localized energy, carbon, and regulatory data into a single platform, Optiml enables decision-making that goes beyond compliance. Users can now move toward strategies that balance sustainability goals with financial performance, ensuring that decarbonization is not seen as a cost center but as an investment in long-term value creation.

This is increasingly critical in today’s market. According to PwC and ULI’s Emerging Trends in Real Estate Europe 2025, sustainability regulation is among the top three concerns for property leaders, alongside financing costs and economic uncertainty. Optiml provides the tools to address these concerns directly, offering clarity in an environment often clouded by complexity.

Looking Ahead: The Future of European Real Estate

To align with the Paris Agreement, Europe’s building sector must cut emissions by 60% by 2030. Missing this target risks not only climate impacts but also financial losses, as stranded assets lose value and capital flows toward greener alternatives.

Optiml’s expansion into 11 new countries positions us to help asset managers and consultants act with confidence, unlocking pathways that are both ambitious and achievable. And this is just the beginning: we’re deepening our platform to deliver comprehensive investment frameworks that balance financial performance, sustainability and compliance.

What’s Next

This expansion marks a significant step toward our vision of building a fully connected, digital ecosystem for real estate asset & portfolio strategy development. As we integrate these new markets, we are already preparing to expand further across Europe and continue enhancing our platform’s intelligence.

For asset managers and consultants across the continent, the path to Net Zero just became significantly clearer and more achievable.

Ready to explore how Optiml can transform your European portfolio strategies? Book a demo to see our Real Estate Decision Intelligence software in action.