The End of “Wait and See”: Why Inaction Became the Riskiest Strategy in Real Estate

As we close out 2025, one thing is clearer than ever: the tone across the real estate industry has fundamentally shifted. What we heard for months — “let’s wait and see” — has now become “we can’t afford to wait any longer.”

Real estate values are declining in real terms, while refinancing risk, the risk of interest rate increases, potential penalties, falling occupancies, rent decreases, and CRREM misalignment have emerged as major industry challenges. ESG’s relevance has declined over the years, accelerated by the EU Omnibus. It now ranks below the top five considerations for the sector (ULI Emerging Trends 2026). What is top of mind for decision-makers are CapEx and decarbonization requirements: how to allocate capital to increase value, and where to hold, sell, or buy, while macroeconomic and regulatory uncertainty (e.g., SFDR 2.0) often prevents companies from acting. Facing these pressures but trapped in a deadlock of inaction, companies have realized that both their ways of working and their existing tools must evolve, moving away from simple spreadsheets, vague benchmarks, and backward-looking reporting toward bankable, forward-looking decision-making at both asset and portfolio levels — even if data are fragmented or the future is unclear. This shift in approach has been a significant driver of Optiml’s progress in 2025.

This year, the industry finally began asking the right question: What’s left to lose?

And the answer has sparked the most decisive movement we’ve seen in years.

2025: The Year the Business Case Became Unstoppable

From Theory to IRR: How Decarbonisation Became an Investment Lever

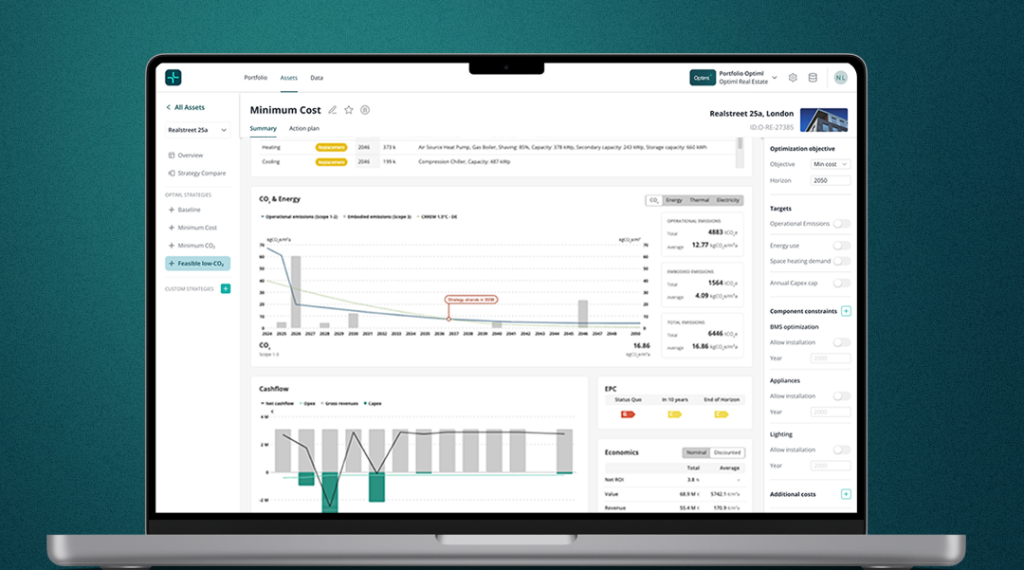

Recognized globally in 2024 and 2025, Optiml stands out for its deep, reliable innovation rooted in over 10 years of ETH Zurich research. With proprietary decision-optimization IP, Optiml has stepped beyond the AI hype and unmet industry promises — demonstrating that the most complex real-world real estate challenges are solvable, creating financial value while meeting the sustainability goals of its clients. As a result, Optiml was recognized as Most Innovative for its Real Estate Decision Intelligence (REDI) software across DACH, Europe, and beyond, underscoring the industry’s recognition that it has built a truly unique value proposition for the sector.

Global Awards included the esteemed ULI PIC Europe, ZIA PropTech of the Year, W.A. de Vigier, >>venture>>, Expo Real Impact Award, apti Award, PropTech Germany Award, Real Estate CH Award (3rd), ZIA Outstanding Innovation, Proptech Startup Europe Award and many more.

Despite the rain in Cannes, there was a sense of clarity at MIPIM 2025. A global consensus emerged: transitioning and increasing performance of assets and portfolios while optimizing for financial value, capital efficiency, and IRR alongside sustainability, is no longer theoretical; it is operational. Asset managers, owners, operators, and advisors worldwide are aligning asset-level and portfolio-level strategies with measurable financial outcomes.

Key trends defined the year:

- Pressure from investors and stakeholders increased on what to do with existing portfolios (hold/sell, renovate), how much to invest at which IRR, and how to finance.

- Despite the decreasing relevance of ESG as a broader term, decarbonization is now reflected in nearly every decision-making stage along the lifecycle — a value driver tied directly to NAV protection and operational performance.

- Waiting is no longer an option. Even if the macroeconomic and regulatory outlook is uncertain, the financial risk of inaction and asset value loss is too high.

- Prioritization of “low-hanging fruit” measures with low CapEx/Opex per CO₂e/kWh and systematic anticipation of grid decarbonization dominate investment plans while maintaining flexibility for future developments.

- CapEx and decarbonization strategies can deliver positive IRR when planned accordingly; such projects exist in every portfolio.

- The era of pilots and promises is ending, as companies move to fully integrate new technologies into their software stacks and workflows, cutting manual work and shifting effort toward higher-value creation, not workforce replacement.

- The age of all-in-one systems has passed; companies now favor best-of-breed solutions that integrate cleanly into their tech stacks and operate across teams, regions, and asset classes — removing fragmentation, data silos, and disconnected decision-making.

Despite years of uncertainty, value decline, and a wait-and-see mentality, a first wave of real estate leaders has broken the deadlock, acting decisively by integrating new decision-intelligence software into daily workflows to unlock capital-efficient, IRR-positive value-add strategies, transition assets at scale, and systematically grow asset values while managing decarbonization as a financial opportunity rather than a constraint.

The “Delay Tax” Has Arrived: How Slow Capex Decisions Quietly Erode NAV

This year, we were invited by Pi Labs to contribute to their white paper on AI for Real Estate Investment Management, providing an outlook for the future of Asset Managers, a timely exploration of the “delay tax”: the invisible but compounding cost of inaction.

The paper highlights:

- How monthly delays erode NAV under tightening ESG and refinancing pressure.

- How data-driven scenario modelling links retrofit sequencing to refinancing, CapEx, and valuation outcomes.

- Pathways to align portfolio performance with transition risk and compliance obligations.

A huge thank you to the Pi Labs team and the PropTech research community for advancing this crucial conversation. The message is clear: decision intelligence is now essential infrastructure.

From ESG Obligation to Performance Opportunity: Where Financial Value Meets Technical Reality

From Blueprint in Las Vegas, Climate Week NYC, to EXPO Real, Proptech Connect in London and RICS Budapest the global industry sentiment converged: valuation, regulation, and technical realities are now inseparable.

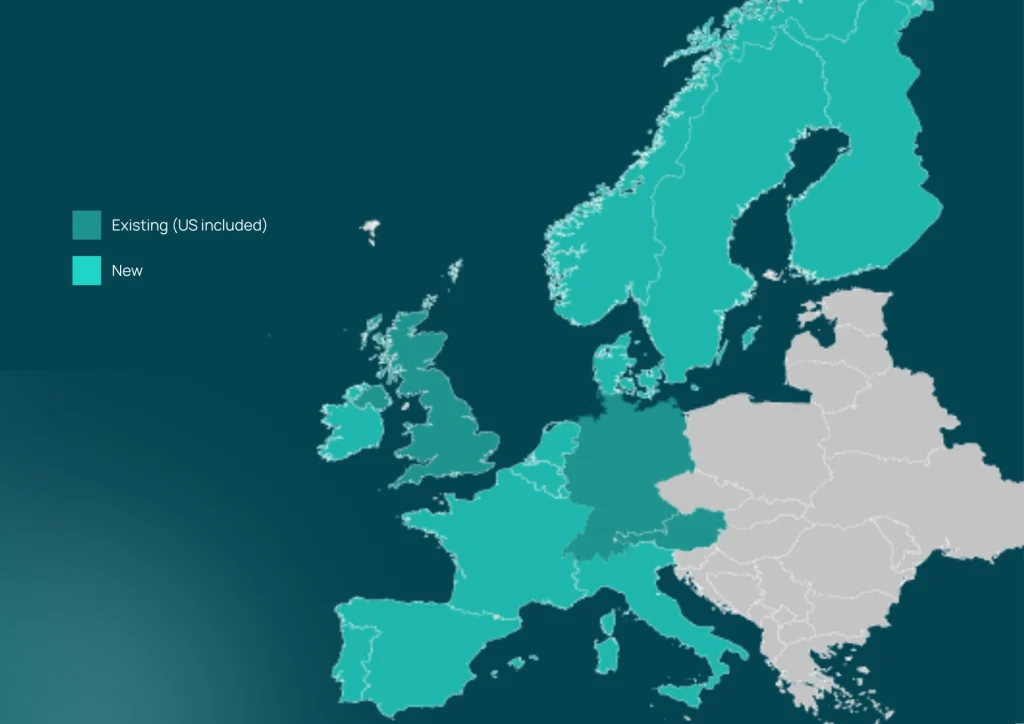

This year, we expanded into 11 new European countries, now covering most of Europe, UK & Ireland, and the US, because every asset in every market deserves access to tools that protect value and unlock opportunity.

Real estate owners and investors in the US continue to lead in digital infrastructure for investment decision-making, targeting IRRs above 20% with sustainability embedded. That mindset is now rapidly spreading across Europe:

- Net Zero is no longer a compliance target; it is becoming a financial performance strategy, which backward-looking ESG reporting fails to address, as value creation now depends on forward-looking CapEx decisions made today.

Where Finance Meets Technical Precision

At EXPO Real in Munich, the focus was (as always) on transactions and capital flows. Even the Federal Minister of Housing, Verena Hubertz, stopped by our booth, speaking with Nico (Co-Founder of Optiml) about the role of technology in driving investment-grade decarbonization in Germany.

At Builtworlds,, the spotlight was on the technical AEC backbone of that transformation: digital twins, AI, and model-based design. Optiml was honored to win the pitch competition, a strong sign that the market is ready for Optiml's bridge between financial and technical intelligence.

This bridge is what our clients need most: answering the financial CapEx question requires technical perspective. Technical consultants need financially powerful modeling to make the business case for sustainability, and asset managers need robust analysis for underwriting.

At Heuer ESG Jahrestagung, we discussed how ESG as a label is losing relevance and a new paradigm is emerging: decarbonization only works when it delivers financial value. Capital efficiency, NAV protection, and IRR-positive CapEx decisions are now prerequisites for action. Traditional ESG reporting and spreadsheets fall short, forward-looking, financially grounded decision models that connect technical asset data with investment logic are required to turn sustainability into a value driver.

At the RICS Built Environment Summit in Budapest, the conversation centered on the green premium vs. brown discount. A new Savills study on 500+ Dutch office leases found "Paris-proof" assets achieving >80% rental premiums, proof that sustainability is beginning to reshape valuations (based on EPCs).

Signals like this are beginning to reshape underwriting expectations and valuation approaches. We discussed this on PropTech Connects webinar Navigating Trade-Offs in Portfolio Optimisation for Maximum ROI with AXA Investment Managers, GRESB, and JLL. The consensus is clear: practical, portfolio-level tools are now the key to balancing returns, carbon, and regulation.

Scaling Decision-Making Across Portfolios with Optiml’s Trusted Real Estate Decision Intelligence Solution

This year, we began partnerships with some of the most innovative and respected real estate firms across Europe and the US, organizations united by a clear ambition: to create lasting value for investors, stakeholders, and clients while meeting sustainability goals as a financial imperative. These leaders recognized that spreadsheets and fragmented tools are no longer sufficient, that inaction is a material business risk, and that value is unlocked when financial objectives, sustainability targets, technical building realities, and regulatory requirements are integrated into a single decision framework.

While our clients span different organization types and market roles, they share the same ambition, to move into the driver’s seat, protect and grow asset value, make decisions grounded in data, and deliver decarbonization with capital efficiency.

Three client examples illustrate how Optiml’s Real Estate Decision Intelligence (REDI) platform creates tangible value by enabling better, faster, and more capital-efficient decisions across portfolios, geographies, and asset classes.

Catella Investment Management, one of Europe’s leading asset managers, is deeply committed to delivering both sustainability impact and strong financial performance for its investors. Optiml supports Catella in translating this ambition into action by enabling data-driven Capex and decarbonization decisions across portfolios in 11 countries, linking asset-level technical measures with financial outcomes such as IRR, NAV, and refinancing implications, and turning sustainability objectives into investment-grade strategies.

PATRIZIA AG, one of Europe’s largest and most innovative global real asset managers, operates across more than 20 countries and all major asset classes. With Optiml’s REDI platform, PATRIZIA strengthens portfolio-wide decision-making by integrating financial planning, sustainability targets, and technical asset data into a unified framework—allowing teams to assess transition pathways, prioritize capital allocation, and manage complex portfolios consistently across regions and investment strategies.

Pensionskasse der BEWAG, an innovative pension fund with a strong commitment to decarbonization, social responsibility, and long-term, stable returns, uses Optiml to navigate the complexity of aligning climate targets with fiduciary duty. By applying REDI, the fund gains transparency on how decarbonization measures, Capex planning, and regulatory requirements impact asset values and long-term performance—supporting informed, capital-efficient decisions that protect beneficiaries while advancing sustainability goals.

We increasingly work with leading real estate and technical consultancies, who have made Optiml their software of choice to meet rising demands for technical depth, reliability, and scalability across large, complex portfolios and geographies. These firms combine Optiml’s data-driven decision intelligence with their deep domain expertise and the trust they have built with clients over many years. This enables a shift away from static energy audits that often sit unused, toward active involvement in client decision-making, budget sign-off, and investment prioritization. By pairing rigorous analytics with targeted building audits, strategies are financially validated, technically sound, and execution-ready—transforming advisory work from periodic reporting into continuous, investment-grade decision support. Clients we closely partner with include Westbridge/agradblue, pom+, Longevity or Telesto Strategy, to name a few.

Optiml works across the full real estate and investment ecosystem, supporting organizations with very different roles but a shared need: to make complex, high-stakes decisions that integrate financial performance, sustainability, technical realities, and regulation.

Asset Managers

We support asset and portfolio managers in meeting fund objectives by planning Capex, defining asset and renovation strategies, adapting to market and regulatory change, driving performance, and steering external consultants and operators with data-backed decisions.

Consultancies

We help real estate and technical consultancies serve clients across the full building lifecycle, manage growing complexity with data-driven insights, strengthen business cases, and win and retain clients through more robust, defensible recommendations.

Indirect Investors (LPs)

We enable indirect investors to engage more effectively with their asset managers co-developing investment and Capex strategies, assessing funding options, and ensuring long-term, risk-adjusted returns for their beneficiaries.

Banks & Lenders

We support banks in identifying risk within loan books, reducing refinancing exposure, managing their own assets, and evolving from pure capital providers into trusted advisors for retrofit and transition financing.

Social Housing Providers

We help social housing organizations balance capital constraints, regulatory limits on cost pass-through to tenants, and social responsibility, while enabling economically viable retrofit and decarbonization strategies.

Private Equity & Multi-Asset Investors

We support lean investment teams in identifying value creation opportunities across countries and asset classes, optimizing buy, hold, and exit decisions over 5–7 year horizons under high return expectations.

Pension Funds

We enable pension funds to align long-term, stable financial returns with social responsibility and climate objectives, often within cash flow constraints and with small, highly focused teams.

Facility Managers

We help facility managers leverage their deep asset knowledge and real-time building data to move beyond fee-based services, creating value-added offerings that directly impact asset performance and investment outcomes.

REITs

We support REITs in managing Capex planning, avoiding regulatory penalties (particularly in the US), and coordinating multiple service providers, despite lean internal teams.

Corporate Real Estate Owners

We help corporations turn operational sites (operating facilities) into managed asset values—optimizing portfolios, controlling costs, and navigating complexity even where real estate is not a core corporate focus.

OEMs & Technology Providers

We enable OEMs to move beyond selling standalone components by embedding their technologies into holistic Capex and decarbonization strategies, expanding service offerings and becoming trusted advisors rather than parts suppliers.

This market signal was reinforced throughout 2025. At the ULI C Change Summit in Paris and the Jahreskongress ESG – CO₂ im Fokus in Cologne, the same conclusion emerged repeatedly: sustainability and profitability are no longer trade-offs. When powered by the right intelligence, they move in lockstep.

As one of our clients summarized in a recent webinar:

“Decarbonisation and IRR are not always misaligned.” — Marvie Haas, Head of Impact Investing, Catella

Another put it more bluntly:

“If you sell a stranded asset with no Net Zero path, you’ll pay the price at exit.” — Benita Schneider, CCO, Westbridge

The alignment between valuation, technical reality, and sustainability is finally here, and the most serious players are acting on it.

The Numbers That Tell the Story

Driving Asset Value by Influencing All Key GAV Drivers

Beyond individual metrics, Optiml’s core value lies in influencing every major driver of Gross Asset Value (GAV), not in isolation, but as an integrated, decision-ready system. By combining financial, technical, sustainability, and regulatory intelligence, our platform allows users to plan, prioritize, and execute actions that directly impact value creation and protection across the full asset lifecycle.

Optiml enables data-driven decisions across all key GAV drivers, including:

- Rental income & occupancy

Unlocking green premiums, protecting demand, and improving letting outcomes through future-proofed assets. - Operating costs

Reducing energy, maintenance, and compliance-related expenses through targeted, capital-efficient measures. - Cap rate

Protecting and improving valuations by reducing transition risk, stranded-asset exposure, and regulatory uncertainty. - Green Capex

Prioritizing “low-hanging fruit” and sequencing investments to maximize CO₂ reduction per euro invested. - Maintenance Capex

Coordinating technical upgrades with sustainability measures to avoid redundant or misaligned spending. - Financing conditions

Improving access to capital and pricing through credible, investment-grade transition pathways.

This holistic view is what allows our clients to move from static analysis to active value steering, turning sustainability from a cost center into a controllable performance lever.

Our achievements

While we're proud of the conversations we've had and the insights we've shared, the real measure of our impact is in the results we've helped our clients achieve:

- 30-70% reduction of Green Capex vs. Audits

- 5x-10x faster creation and sign-off of capex and decarb strategies

- Value-at-risk down from 10% to less than 1%

- 70% CO2e (operational) reduced over lifetime vs. planned strategy

- 80%+ reduction in time required for portfolio analysis and strategy development

But behind every number is a decision made with confidence. A portfolio optimized for both performance and impact. A team empowered to move faster and smarter. A building given a pathway to a sustainable future.

Looking Ahead to 2026: A New Phase of Acceleration

As we enter 2026, three truths define the industry:

- The business case is proven.

- Decision intelligence has become an operational necessity.

- The opportunity to create both returns and impact has never been greater.

In the year ahead, we will:

- Expand platform capabilities with deeper financial and technical intelligence

- Strengthen global partnerships across asset management, finance, and technology

- Support more organisations as they navigate the transition with confidence and precision

- Continue to be a trusted partner on eye-level, not just software provider, delivering on our promises, with the deep expertise and seniority in our team to be trusted with the most precious activity in the industry: asset value and Capex

- Most importantly, we will continue listening — because the future of real estate will be built by an industry willing to challenge assumptions, embrace intelligence, and make bold decisions that serve both people and the planet.

The transformation is underway.

Dr. Evan Petkov (Co-Founder & CEO) & Nico Dehnert, MRICS (Co-Founder & CCO)